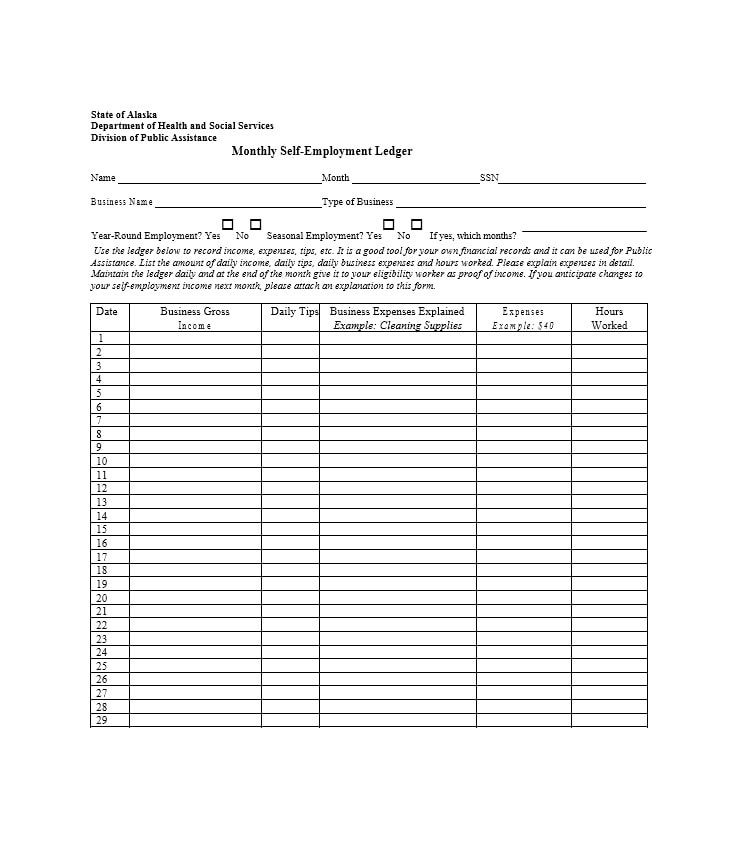

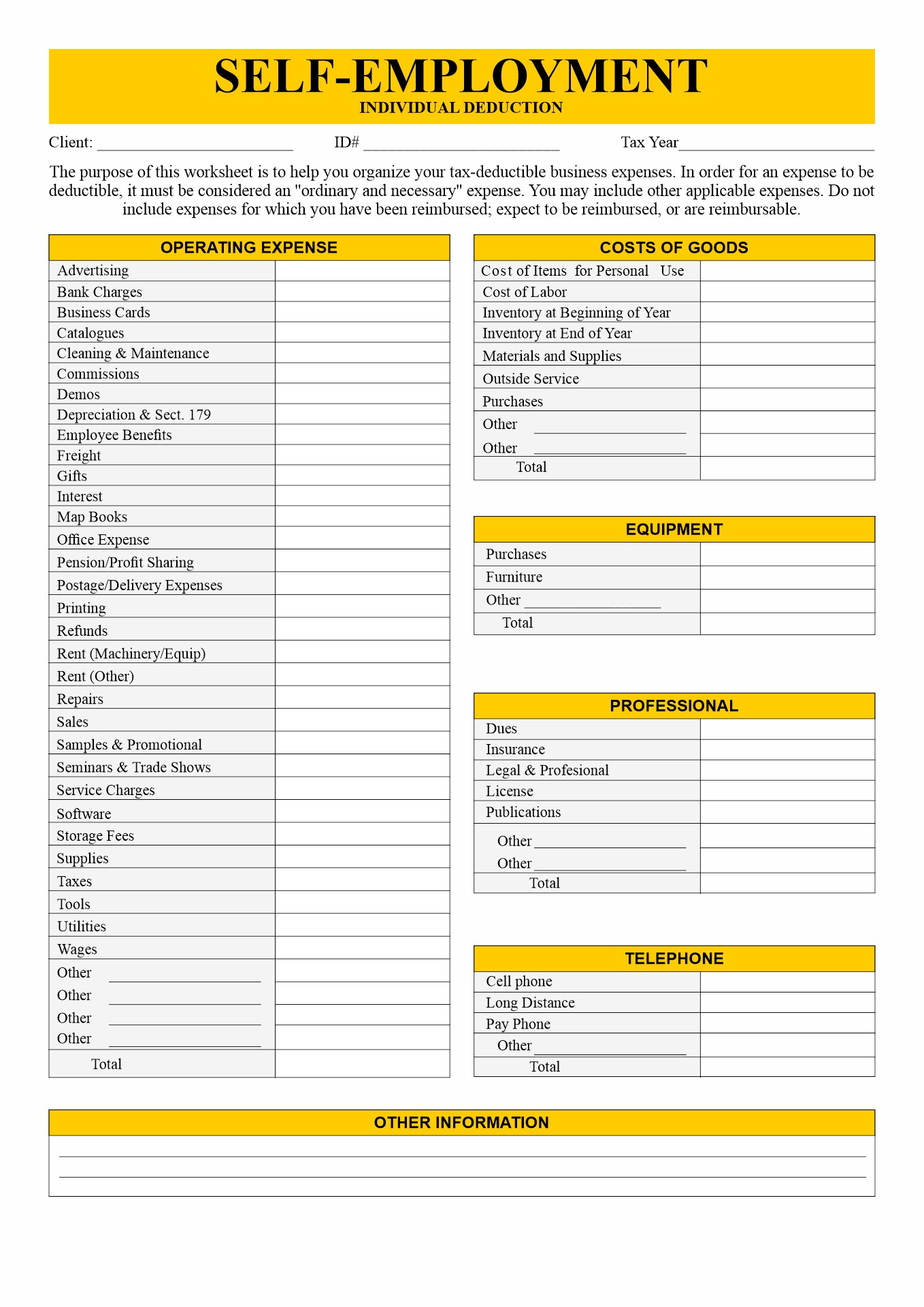

Self Employment Deduction Worksheet. If you work from your home or use part of it in your business, a few self-employment tax deductions could get you a break on the cost of keeping the. General partners in partnerships and actively participating members in LLCs that are treated as partnerships can claim the deduction if they have any self-employed income, as can.

When you're completing your Self Assessment tax return, you'll need to work out your expenses, as you can subtract some of these from your turnover to work out your taxable profit.

In this video we will explain who self-employment taxes The internal revenue code allows you to deduct one half of your self-employment taxes.

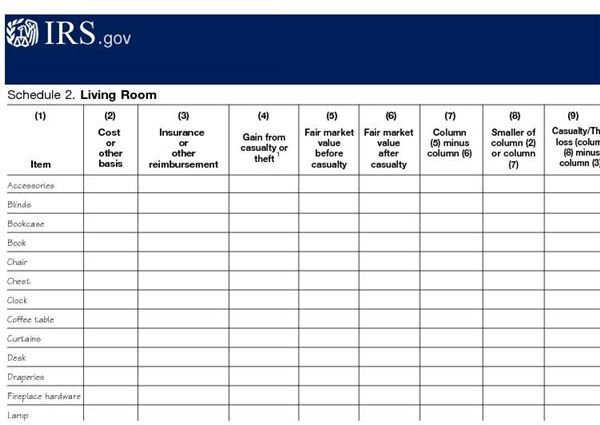

You do not have to draw up formal accounts each year but you must keep sufficient records to The deductions are shown on payment and deduction statements that your contractors should have given to you. But if you're self-employed, your liability is extra costly. If you work from your home or use part of it in your business, a few self-employment tax deductions could get you a break on the cost of keeping the.